How does it work?

Both products will have the same benefits, the only difference being the capital protection required. If the price of West Texas Intermediate Crude Oil rise you will receive the upside participation.

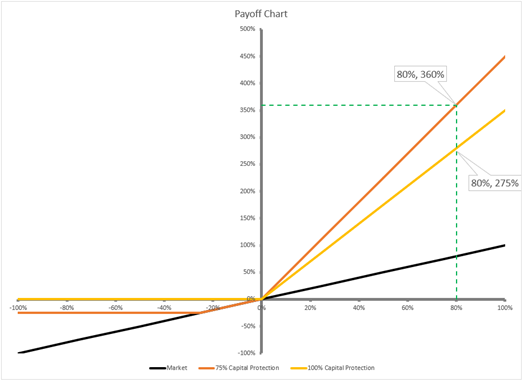

As an example, if the WTI Crude Oil price goes up by 80% you will receive a return of 275% or 30.26% annualised per annum for Product 1. For Product 2 you will receive a return of 360% or 35.69% annualised per annum.

If the WTI Crude Oil prices drops by 30%, you will still receive your capital at the end of the term for Product 1. For Product 2 you would only be subject to 25% capital loss and not the full 30%.

From R50 000 you can take advantage of this limited offer now.

Let the rising oil price grow your investment.

|