At Global & Local Asset Management, we understand the challenges investors face when navigating the current financial landscape, which is rifled with uncertainty. That’s why our team of seasoned experts have developed a comprehensive range of funds that aim to provide stability, mitigate risks, and deliver consistent performance over the long term. By combining disciplined investment strategies with a deep understanding of market dynamics, we strive to empower our clients to achieve their financial goals while weathering market uncertainties with confidence. Below are our three flagship funds, each designed to smooth market volatility and generate superior risk-adjusted returns.

Global & Local SNN Balanced Fund of Funds

The fund uses state-of-the-art software developed by Salient Quantitative Investment Management (Pty) Ltd for asset allocation. With the software, the fund explicitly measures and controls risk level and exposures allowing risk budgeting to be implemented in portfolio construction. The fund efficiently allocates the risk and optimally diversifies the allocation to underlying funds. The Global & Local SNN Balanced Fund of Funds invests in other funds from different asset managers such as Allan Gray, Integrity Asset Management, Lunar Capital & Ninety One.

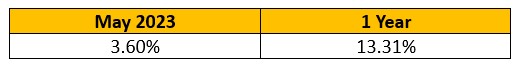

Performance figures as at 31 May 2023.

Global & Local SNN Balanced Fund of Funds Minimum Disclosure Document

Global & Local SNN Worldwide Flexible Fund

The G&L SNN Worldwide Flexible Fund is a multi-asset worldwide flexible portfolio. The portfolio’s investment objective is to achieve superior long-term risk adjusted returns by actively investing across different asset classes, both locally and offshore.

The fund uses a top-down investment strategy which combines Global Macro Economic Trends with innovative financial technology, quantitative minds, and active investment management which we believe would lead to positive investment outcomes. The fund currently has exposure to the following sectors: Uranium, Gold, Agriculture, Natural Gas and Oil as the main themes.

Performance figures as at 31 May 2023.

Global & Local SNN Worldwide Flexible Fund Minimum Disclosure Document

Global & Local SNN Offshore Equity Fund

A common myth is that to generate higher portfolio returns an investor must take on more risk. That is not true at all. Some types of risks result in losses rather than greater returns. The Global & Local Offshore Equity fund avoids these risks and by doing so increase the return. The fund is a quantitative fund that allocates exposure to stocks with low Expectation Risk Factor (ERF*) in the following regions U.S Large Cape, UK, Europe ex-UK and Japan. The ERF calculates the probability the company will fail to deliver the growth implied by its stock price. Using the ERF as the foundation of our investment methodology, we can apply these probabilities to the fund and aim to provide a differentiated and uncorrelated source of outperformance by simply avoiding the losers – overpriced stocks caused by human behaviour.

Performance figures as at 31 May 2023.

Global & Local SNN Offshore Equity Fund Minimum Discloure Document

*We obtain the ERF scores from a New York based company “New Age Alpha”.